Tax Incentives to Outsource Fulfillment in Nevada over California

Many companies need a third party logistics company to facilitate shipments to the United States. A Nevada 3PL company can prove to be invaluable in terms of reducing your overall California business costs. When choosing a fulfillment provider you should consider the following about Nevada:

Many companies need a third party logistics company to facilitate shipments to the United States. A Nevada 3PL company can prove to be invaluable in terms of reducing your overall California business costs. When choosing a fulfillment provider you should consider the following about Nevada:

If you are looking for a 3PL company you should consider the advantages Nevada has over California. Nevada is ranked 3rd in the 2013 State Business Tax Climate Index, compared to California at 48. Nevada has many business assistance programs to attract industrial users to the Northern Nevada market including sales and use tax abatement, sales and use tax deferral and personal property tax abatement. Nevada does not have state income tax, unitary tax, corporate income tax, inventory tax, franchise tax or special intangible tax.

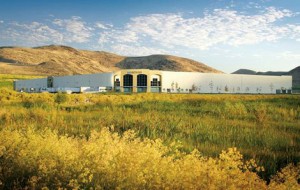

Employing Hopkins as your 3PL company will entitle you to all of the Nevada tax benefits mentioned above. Contact Hopkins Distribution to discuss your specific West Coast distribution needs today!